Systematic risk refers to the risk inherent to the entire market or market segment. Systematic risk, also known as “undiversifiable risk,” “volatility” or “market risk,” affects the overall market, not just a particular stock or industry.

What is Systematic Risk?

Systematic risk refers to that portion of total volatility in return on investment caused by factors affecting the prices of all the securities in the portfolio. Systematic risk is also known as market risk.

Economical, political, and sociological changes are the main sources of systematic risk. Their effect is to cause prices of nearly all individual assets like common stocks, bonds, and other securities in the market to move together in the same manner.

Systematic risk affects the economic or financial system as a whole. It is sometimes also called pervasive risk.

Key Points:

- Systematic risk is inherent to the market as a whole, reflecting the impact of economic, geopolitical, and financial factors.

- This type of risk is distinguished from unsystematic risk, which impacts a specific industry or security.

- Systematic risk is largely unpredictable and generally viewed as being difficult or impossible to avoid.

- Investors cant somewhat mitigate the impact by building a diversified portfolio.

Read: Systematic risk VS Unsystematic risk

Types of Systematic Risk

Systematic risk includes market risk, interest rate risk, purchasing power risk, and exchange rate risk.

Market Risk

Market risk is caused by the herd mentality of investors, i.e. the tendency of investors to follow the direction of the market.

Hence, market risk is the tendency of security prices to move together. If the market is declining, then even the share prices of good-performing companies fall.

Market risk constitutes almost two-thirds of total systematic risk. Therefore, sometimes systematic risk is also referred to as market risk.

Market price changes are the most prominent source of risk in securities.

Interest Rate Risk

Interest rate risk arises due to changes in market interest rates. In the stock market, this primarily affects fixed-income securities because bond prices are inversely related to the market interest rate.

In fact, interest rate risks include two opposite components: Price Risk and Reinvestment Risk. Both of these risks work in opposite directions.

Price risk is associated with changes in the price of a security due to changes in interest rate.

Reinvestment risk is associated with reinvesting interest/ dividend income.

If price risk is negative (i.e., fall in price), reinvestment risk would be positive (i.e., increase in earnings on reinvested money).

Interest rate changes are the main source of risk for fixed income securities such as bonds and debentures.

Purchasing Power Risk (or Inflation Risk)

Purchasing power risk arises due to inflation. Inflation is the persistent and sustained increase in the general price level.

Inflation erodes the purchasing power of money, i.e., the same amount of money can buy fewer goods and services due to an increase in prices.

Therefore, if an investor’s income does not increase in times of rising inflation, then the investor is actually getting lower income in real terms.

Fixed-income securities are subject to a high level of purchasing power risk because income from such securities is fixed in nominal terms.

It is often said that equity shares are good hedges against inflation and hence subject to lower purchasing power risk.

Exchange Rate Risk

In a globalized economy, most companies have exposure to foreign currency. Exchange rate risk is the uncertainty associated with changes in the value of foreign currencies.

Therefore, this type of risk affects only the securities of companies with foreign exchange transactions or exposures such as export companies, MNCs, or companies that use imported raw materials or products.

Calculation of Systematic Risk (β)

Systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company, such as economic, political, and social factors.

It can be captured by the sensitivity of a security’s return with respect to the overall market return. This sensitivity can be calculated by the β (beta) coefficient.

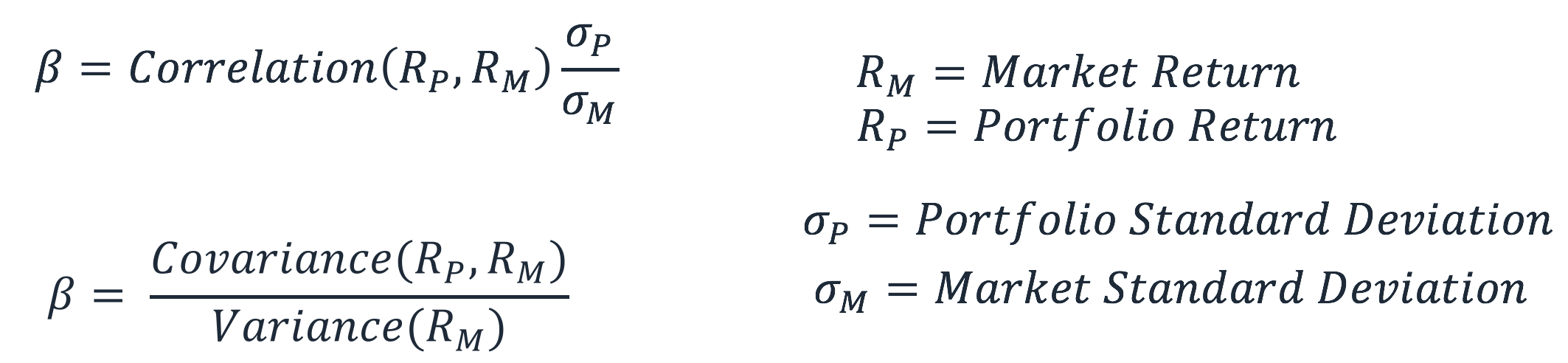

The value of β can be calculated using the following formula:

The Beta of a stock or portfolio measures the volatility of the instrument compared to the overall market volatility.

It is used as a proxy for the systematic risk of the stock, and it can be used to measure how risky a stock is relative to the market risk.

When used as a proxy to measure systematic risk, the β value of a portfolio can have the following interpretation.

- When β = 0 it suggests the portfolio/stock is uncorrelated with the market return.

- When β < 0 it suggests the portfolio/stock has an inverse correlation with the market return.

- When 0 < β < 1 it suggests the portfolio/stock return is positively correlated with the market return however with smaller volatility.

- When β = 1 it suggests that the portfolio return has a perfect correlation with the market portfolio return.

- When β > 1 it suggests that the portfolio has a positive correlation with the market, but would have price movements of greater magnitude.

2 comments on “What is Systematic Risk? Types, Formula, Example”